- Get link

- Other Apps

- Get link

- Other Apps

The idea of money laundering is essential to be understood for those working within the financial sector. It's a process by which dirty money is transformed into clear money. The sources of the money in actual are felony and the money is invested in a method that makes it look like clean money and hide the identity of the prison part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining current prospects the responsibility of adopting satisfactory measures lie on every one who is part of the organization. The identification of such factor to start with is simple to take care of as an alternative realizing and encountering such conditions in a while in the transaction stage. The central financial institution in any country supplies full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such conditions.

Hastings International UK an estate agent with two offices in south London was fined 47966. Generally estate agents are regulated by HMRC but they should also follow their countrys regulations or affiliates.

Pdf Evaluating The Control Of Money Laundering And Its Underlying Offences The Search For Meaningful Data

Compliance obligations for estate agent As per the FIC Act Estate agents are required to apply a risk-based approach RBA when implementing controls to combat money laundering and terrorist financing MLTF.

Money laundering fines estate agents. Agents are required to carry out checks on buyers and sellers under the Money Laundering Regulations. UK regulators conducted unannounced inspections of 50 estate agents and disclosed fines against Countrywide and other businesses as part of a crackdown on money laundering HM Treasury said Monday. Powering the global fight against financial crime.

Why There Is a Risk of Money Laundering in Estate Agents. The RBA requires estate agents to determine the MLTF risks their clients pose to their businesses through the products that they offer. The visits came as HMRC published the latest businesses hit with fines for failing to comply with the regulations.

The biggest fine an estate agency is known to have received for failing to comply with money-laundering legislation was the eye-watering 169000 sanction issued by the now-defunct Office of Fair Trading to Jackson Grundy in 2014. It was one of three agents fined massive amounts the others being London firm Hastings International which was fined 47966 and Jeffrey Ross of Cardiff hit with a 29000 fine. This can result in unlimited fines with imprisonment of up to 2 years.

Politics News -Errant real estate agencies and property agents will face higher maximum fines of 200000 and 100000 respectively for each case of breaching industry guidelines under a Bill. Huge fines for three estate agents. Businesses that are found to breach the regulation are issued with hefty fines according to Mark Hayward chief executive of National Association of Estate Agents.

Countrywide Estate Agents has been fined 215000 for failing to adhere to money laundering regulations. Countrywide Estate Agents has been fined UK215000 by HM Revenue Customs for anti-money laundering failures in policies and controls at group level as well as in its due diligence when it undertook verification and for deficiencies in record keeping. This follows the 215000 fine given to Countrywide i n March last year for similar offences.

Three estate agents based in London Northamptonshire and Cardiff have been fined a total of 246665 by the OFT for failing to comply with the Money Laundering Regulations 2007. The OFTs duties on money-laundering were handed to HMRC on April 1 2014 and so Jackson Grundys appeal was versus HMRC. The company was fined for failing to ensure that its money-laundering.

Purplebricks has issued a statement saying the breaches took place in 2018 and that it has. Estate agents are being fined millions for failing to prevent money laundering -- but the fines are not publicly being made known Camilla Hodgson Jan 22 2018 554 PM. Its a criminal offence to trade as an estate agency or letting agency business without being registered or after your registration is cancelled with HMRC for money laundering supervision.

Purplebricks has been given a 266973 fine by HM Revenue Customers for breaches of money laundering rules the largest ever given to a UK estate agency. Online estate agent Teplio which was fined 68959 was among four other estate agencies that were also penalised in the latest list. For the first time HMRC have revealed 25m of penalty notices have been issued since the implementation of the 4th Money Laundering Directive in June 2017 across all sectors.

Estate agents may face fines or criminal prosecution if they do not comply with regulations. This includes estate agent Countrywide Estate Agents receiving a 215000 fine. Because of this risk estate agents should prevent Money from financing terrorist activities by doing Money Laundering Controls.

Estate agent anti-money laundering AML compliance is under scrutiny again following the publication of figures detailing the fines levied for AML non-compliance. Estate agent anti-money laundering AML compliance is under scrutiny again following the publication of figures detailing the fines levied for AML non. Estate agent group Countrywide has been hit with a 215000 fine by HMRC for money-laundering failures.

Anti Money Laundering Ultimate Guide Training Express

Layering Aml Anti Money Laundering

Layering Aml Anti Money Laundering

Pdf A Review Of Money Laundering Literature The State Of Research In Key Areas

Amld5 And Its Effect On The Real Estate Market Getid

Anti Money Laundering What It Is And Why It Matters Sas

Pdf Anti Money Laundering Regulations And Its Effectiveness

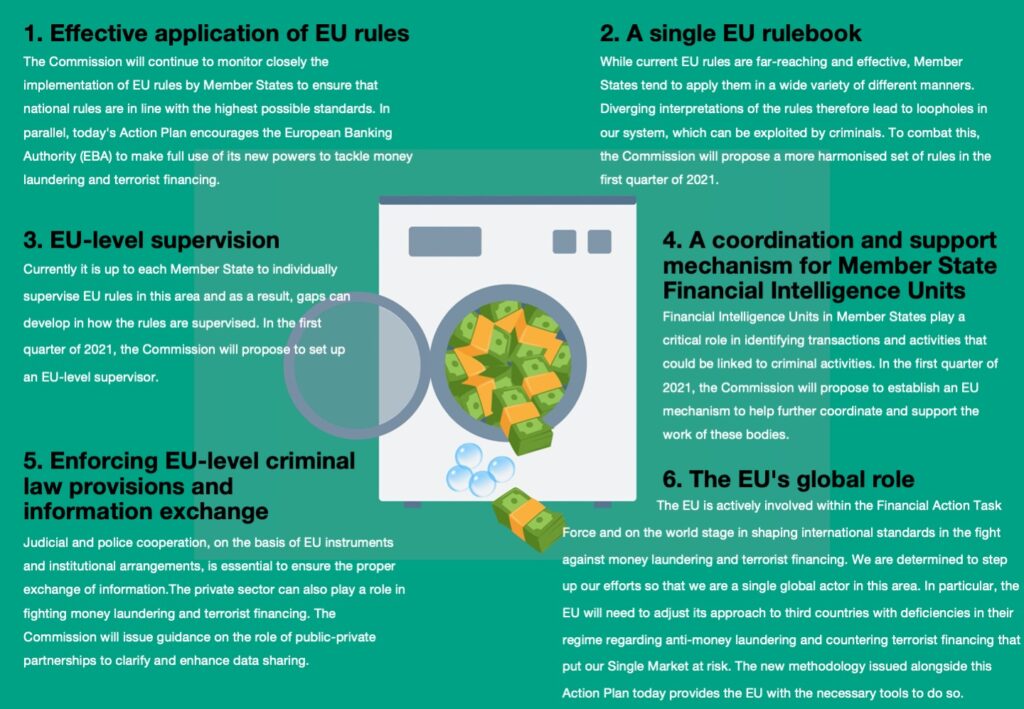

When One Door Shuts Another One Opens The Commission S New Aml Action Plan Planet Compliance

Money Laundering What Are The Obligated Subjects

Revised Central Bank Amla Guidelines Anti Money Laundering

A Guide To Anti Money Laundering Aml Compliance Veriff

Https Www Ppatk Go Id Backend Assets Uploads 20200221111540 Pdf

Anti Money Laundering Overview Process And History

The world of laws can appear to be a bowl of alphabet soup at instances. US cash laundering regulations are no exception. We've compiled a list of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting agency targeted on protecting financial providers by lowering threat, fraud and losses. We now have big financial institution experience in operational and regulatory danger. We have now a powerful background in program management, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many adverse consequences to the organization due to the risks it presents. It will increase the chance of major dangers and the opportunity value of the financial institution and in the end causes the financial institution to face losses.

Comments

Post a Comment